Did you know that the third largest stock exchange in the US is in a strip mall outside Kansas City, Missouri between a Latte Land coffee shop and a Land of Paws pet boutique? I didn’t either. Newsweek has the story:

Each trading day, as a bell atop the M&I Bank building next door chimes gently, BATS quietly conducts about 25 times the volume of the venerable American Stock Exchange. Here, 1,200 miles from the financial center of the world, a few dozen employees pad around in shorts and polo shirts, amid green cubicles and whiteboards. On any given day, its servers off in New Jersey will process about 12 percent of the trades made in the vast U.S. markets. In less than 36 months, BATS (it stands for Better Alternative Trading System) has evolved from a start-up into an international stock exchange with powerful partners and a nine-figure valuation. “We’ve really been able to get to critical mass in a very short time,” says CEO Joe Ratterman, who, with his blue jeans and shaved head, resembles a dot-com entrepreneur more than the bespoke-suited managers in New York.

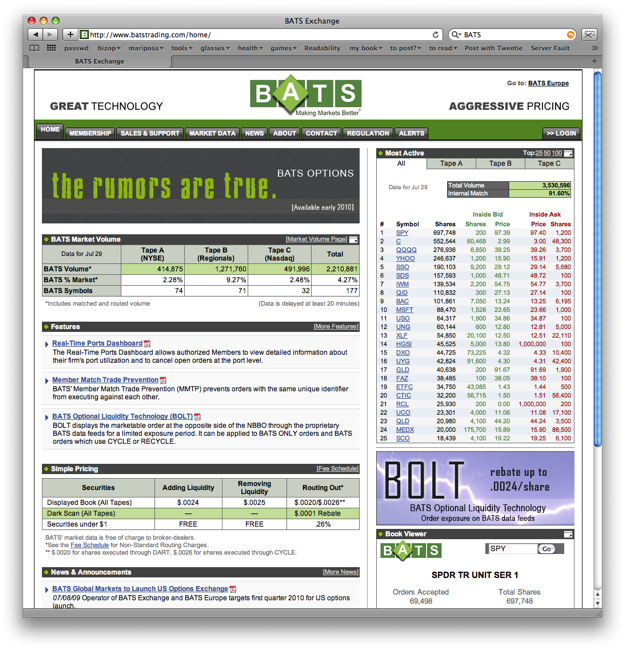

BATS is in fact pretty much a technology start-up. Alternative trading systems like BATS–which are also known as ECNs (electronic communication networks)–are digital swap meets for professional stock traders. They began to proliferate in the 1990s, offering cheaper trades and faster execution than powerful, but less nimble, incumbents like the New York Stock Exchange and the NASDAQ. The big shots decided to buy rather than fight; NYSE bought ECN Archipelago in 2000, and NASDAQ bought Inet in 2005.

Once they became subsidiaries of big exchanges, the ECNs had less incentive to compete with them on price. So the consolidation left a gaping hole in the market. Dave Cumming, founder of a Kansas City-based trading firm, and 12 other people–including Ratterman, 41, a veteran of financial-information companies–started BATS with about $2 million in the summer of 2005. It sounded like a financial version of the movie “300”–a hopelessly undermanned group taking on a giant army. But in the 21st century, you don’t have to be a big firm in lower Manhattan to compete on the three factors that made ECNs succeed–speed, cost and service. Not being there proved to be an advantage.