Business News Daily recently took a look at some of the issues that small businesses will have to face during the new year. So, what are some of the issues you should anticipate while planning how to operate your business?

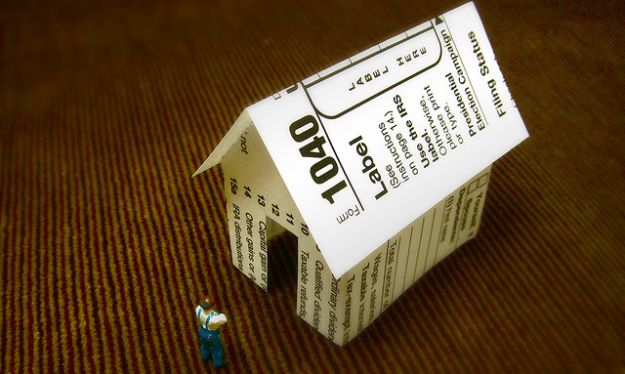

1. Tax changes — In 2011, businesses will confront the increasing complexity of the tax environment, including the implementation of a partial payroll tax holiday, the ability for businesses to expense 100 percent of their capital investments, and the retroactive extension of many temporary business tax incentives that expired at the end of last year.

2. Health care reform – A key aspect for 2011 is the provision providing business tax credits for small employers that purchase health insurance, which is effective for tax year 2010 and carries into next year.

3. FSA plans – Effective January 1, 2011, over-the-counter medicines and drugs other than insulin (i.e., aspirin) will no longer be eligible for reimbursement from a health FSA unless the item is prescribed by a medical practitioner.

4. Unemployment Insurance rates/changes – Many employers will see a trend that promises to send state employer UI contribution rates higher in 2011 to replenish depleted UI trust funds and repay federal loans taken to allow states to continue to pay benefits.

5. Employment law – The United States Department of Labor and many states have enacted or are considering measures to provide greater transparency to workers on the wages they are owed, especially in key areas such as minimum wage and overtime requirements, and to increase penalties on those who fail to pay their workers the compensation they are entitled.

Read on.

Photo by JD Hancock