Let The Annuity Calculator Plan for Your Future

Most people work diligently their entire life to prepare for retirement.

Many old timers had no other options than social security; which is one of the best ways to prepare. Today, most employers provide their employees with 401k benefit options. But as employers, we don’t always have a laid out plan.

So what exactly is an annuity calculator and why might your company need one?

Annuity

Annuities are agreements to make payments over a specified period for a predetermined amount. Many life insurance companies use these contracts, when the payout is large. They are often used to ensure the contract owner they will not outlive their income.

Funds cannot be withdrawn, without penalties. To avoid penalties, many contract owners will wait until they are 59-1/2 years old, before they withdraw any funds from the account.

Buying Annuities

Investors can purchase annuity contracts outside or inside the IRA. In both cases, the investor must need to write a check to the annuity carrier. They are also available through the 1035 exchange, where a life insurance or endowment policy is transferred into an annuity policy, without penalties. Life insurance policies, such as universal, universal variable or whole can be interchanged into an annuity account.

Calculating Annuities

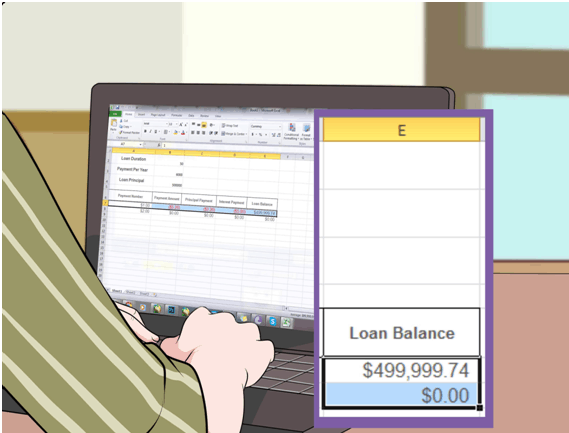

The calculator can provide investors with the precise payment that would deplete the fund in a specified time period, and the amount required to generate a predetermined payment. It can also find the number of years the investment will generate payments. Using the calculator is the best way to determine how much money you want to invest in an annuity contract. It can also help you form the right decision on whether or not to place an annuity within a retirement plan.

The calculator is available to everyone and is free to use. You can also change it as often as you feel necessary. Once you input the monetary values into the calculator, you will receive your results in both graph and written form complete with annual balances.