Whether for business or for personal reasons, budgeting your money shows a sense of responsibility for putting your finances on the right track. However, if you feel you need a little help, check out the budgeting apps we describe in this post. What’s more, any one of them will empower you to manage your finances more easily.

That’s because budgeting will help you to understand your current expenses and forecast future ones. Therefore, every business—as well as every individual—should go through this critical process.

RELATED ARTICLE: BEFORE YOU BEGIN: HOW TO CREATE A REALISTIC BUDGET FOR YOUR STARTUP

To get started, simply download one of the budgeting apps we discuss here. They’re all created by top financial app development companies. Plus, they will help you to make smarter decisions on the go, because they will give you flexibility with your budget. In other words, you’ll be able to adjust your expenses and revenue using real-time data.

Mint

With its more than 20 million users, Mint is one of the more popular budgeting apps available today. That’s likely because users love its accurate and instant calculations. What’s more, this app will track all of your financial operations and offer valuable advice, too. Therefore, you’ll be able to manage your money more easily. Plus, iPhone or Android users can download this app for free. Additionally, iPhone users can synchronize the app with Apple Watch as well.

Features

- Create budgets and track investments quickly and easily

- Get real-time access to reports and other information

- Instant alerts

- Budget for as many categories as you like

- Works well with variable expenses

- Generates customizable reports

- Provides quick analysis

- Secure access

- Data encrypted

- Intuitive features and powerful results

- Personalized tips and advice

- Makes it easy to track your credit score

- Gives you real-time results

- Free to download

A study from a top research company points out that end user needs are a key factor affecting mobile app development. Therefore, app developers need to keep users in mind while they are designing their apps.

Judging by the features and functionalities of the Mint app, this app appears to be driven by this logic. For example, just a few taps allow its users to perform various functionalities with regard to their finances. What’s more, the Mint app is an absolutely free budget planner that will walk with you wherever you go.

You Need a Budget (YNAB)

“Managing your budget does not have to be stressful,” says Jesse Mecham in his book, You Need a Budget.

The YNAB app is an award-winning financial and budgeting app that helps you gain financial peace, control, and stability. Remarkably, PCWorld listed this app under its editor’s choice list. In their notable review they note that the app is more than a budgeting tool. That’s because it can also enable users to improve all of their money habits.

Features

- A complete budgeting app

- Access to your real-time info

- Easily syncs all your bank accounts

- Real-time access to data

- Quick sharing

- Detailed spend report

- Advice on trends

- Debt Paydown tool

- Simple goal tracking

- All-time support

- Free trial for a specific period

As the name suggests, the app lets you plan a budget with the finances you have and those that you may acquire. Further, the app has some of the best features to help you set a balance between your earnings and your spending. In other words, the app helps you to be proactive instead of reactive.

“Instead of spending more, spend better,” said one financial advisor. YNAB is an app that will help you to accomplish this goal. Along with helping you to create a proper budget, the app guides, educates, and coaches you to manage your money in the best way by keeping your income in consideration.

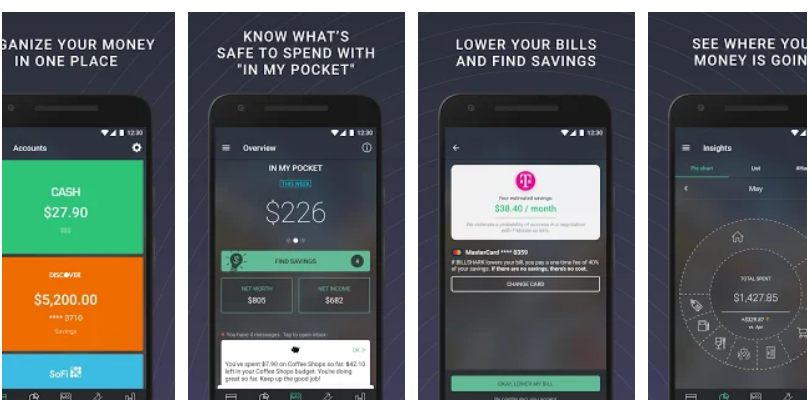

PocketGuard

Budgeting is boring no more. That’s because PocketGuard makes money management easier than ever. What’s more, this app acts as an investment advisor, too. And it’s one that you can easily trust. With PocketGuard, you will control your money, your bills, and your budget on your phone. What’s more, you will do so anywhere and at any time.

Features

- Puts your budget on autopilot

- Personalized budget based on your income, bills and goals

- Connect with your credit cards and other investments

- Sync with your existing loans

- See all your finances in one place

- Instantly tracks each of your transaction and spend

- “In-my-pocket” facility allows you to understand your limit to spend

- Advice to improve your financial health

- Secured

This app will sync your bank accounts, loans, credit cards, and investments. What’s more, it will track all your bills and subscriptions. Plus, it will track your income, too. Then, it will automatically suggest to you a budget based on your spending patterns. Plus, it will alert you to unwanted risks. Such features make this app a standout when it’s compared with other apps.

Budgeting Apps Will Transform Your Finances

Mobile apps are transforming many aspects of modern life, and the financial sector is no exception. Moreover, this transformation is driving a strong move toward self-service and improved functionalities.

Budgeting apps such as the ones discussed in this article will help you to manage your finances better. Plus, many of them are free to download.

In this digital age, a well designed mobile financial planner, such as these budgeting apps, can add a lot of value and help you to stick to the process of managing your money well.

About the Author

Meenakshi Krishnan is a content consultant. A techie at heart, Meenakshi is passionate about the start-up ecosystem, entrepreneurship, the latest tech innovations, and all that makes this digital world. When she is not writing, she loves to read, cook, and paint.