The US-China trade war has done more than just ruffle a few feathers in recent months. For Asia-Pacific traders and producers, the idea of an ongoing long-term trade war is becoming a reality. Moreover, the situation is unlikely to ease off for at least a few years. So we spoke to Deepesh Patel at Trade Finance Global (TFG) to ask him what this trade war means for international trade. We wanted to know how trade flows could change.

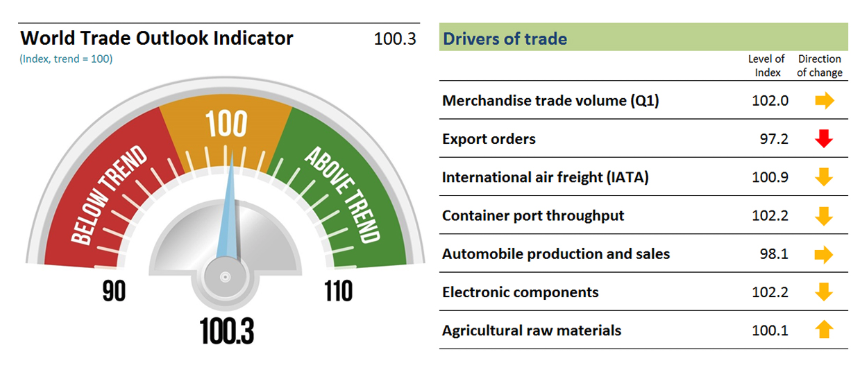

Patel explained that global markets are now preparing for a full-blown trade war. Initially, banks did not feel the effect of trade tensions. However, the World Trade Organization, or WTO, recently reported softening trade flows as trade tensions continue. These trends appear to be driven by a decline in export orders.

WTO Indicator, 2.10.18. Source: WTO

What Is Happening?

The current trade war between the United States and China began in January 2018. At that time, the US imposed a tariff on solar panels which the US was importing from China. Beijing responded in kind with similar but opposing measures. As this trade war continues to escalate, both countries are prepared to raise tariffs a further 25% in January 2019.

China tends to work with manufacturers and suppliers of the smaller developing Asian economies such as Bangladesh and Taiwan. As confidence in the market slips, traders in those countries have become more cautious, slowing procurement in China. In domino fashion, South Asian suppliers are beginning to suffer from a dearth of orders as producers see lower prices for their goods.

Nonetheless, US consumers would be hit by increased costs. That’s because many US-based hardware companies source their components from China. In early September, Apple’s CEO Tim Cook wrote about his opposition to these trade tariffs in a letter to the United States trade representative.

China has little room to negotiate. That’s because there are only a few goods China could impose new tariffs on. However, it could look at increasing tariffs on some other goods. And it could place unfavorable taxes and charges on US companies that are based in China.

RELATED ARTICLE: GO GLOBAL: 6 KEY BENEFITS OF EXPANDING YOUR BUSINESS INTERNATIONALLY

Globalization, Nationalism, and Internationalism

Therefore, companies around the world are beginning to prepare for what looks like a gloomy winter ahead. That’s because trade animosities are not limited to only China and the US. Earlier this year, Singapore announced trade tariffs on more than 900 goods in an attempt to prevent a weakening of the rupiah, its local currency. This is despite the fact that Singapore is often hailed as a beacon of free trade among the Tiger economies.

In May 2018, loan books showed positive growth. Moreover, investments in projects and infrastructure were booming. Favorable interest rates and credit availability completed the positive outlook. However, fast forward just a few months and we see a market preparing for a storm. This is particularly true within the commodity finance space. Here we see a slowdown in larger, longer-term contracts.

The New Normal

Navigating the stormy seas of trade and supply chain finance in a new era of trade wars is no easy task.

Tariffs will certainly affect the supply chain of the debtor. Here, it’s likely that both financiers and insurers will look at the effect this trade war could have on a business before they make any decisions about lending. Additionally, the effect of the wider trade war could affect global growth. Moreover, when growth weakens, insolvencies will probably increase. This means credit limits could decrease while the cost of capital increases.

Therefore, if you are a business owner or treasurer in a business, consider the effect of these new tariffs on your company’s profits and losses. You might also want to identify alternative suppliers across different markets. Additionally, consider and begin to plan for the potential effect on your business of financing your future operations.