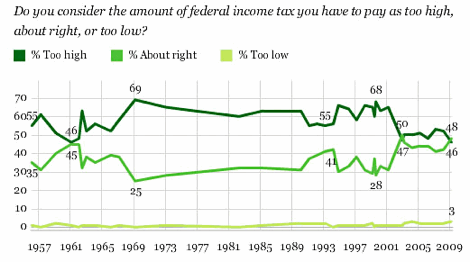

Unhappy with your 2008 taxes and got the tax day blues? Who doesn’t? Well, according to a new poll from Gallup, 61% of Americans think that their taxes are just right or even a little low. But, guess what:

Consider this: about 40-50% of Americans pay no federal income tax at all. That’s zero dollars. I think we can safely assume that these are the people who think their taxes are about right. What this means, then, is that virtually every American who pays any income tax at all thinks they’re paying too much.

So what are we going to do about next year? I know what I’m going to do, because I read The Tax Lady’s Guide to Beating the IRS and Saving Big Bucks on Your Taxes by Roni Lynn Deutch. It is the best tax advice book I’ve ever read, because of two simple paragraphs that have changed my perspective on business record keeping entirely:

Still, to be a successful, innovative business owner, [record keeping] is a responsibility that must be met. Good record keeping could be the difference between recording your annual balance sheets in red ink or black. In fact, the University of Maine Cooperative Extension claims you can save $100 per hour solely by keeping good records. How, you ask? Well, imagine you have a $20 business expense that you failed to record or maintain a receipt. This failure raises your business’s net income by $20. Overstating your net income by $20 causes your Social Security tax to go up $3.06 (i.e., $20 times 15.3 percent for a self-employed person), your federal income tax to go up $4 (i.e., $20 times 20 percent — assuming you are in the 20 percent tax bracket), and your State Income tax to go up $1 (i.e., $20 times 5 percent — assuming you are in the 5 percent tax bracket for your state).

As you can see, this $20 oversight has now cost you $8.06 more in taxes (i.e., Social Security, federal, and state). No, how much time do you think it would have taken you to record this expense or maintain this receipt? Five minutes, tops, right? So, had you spent this five minutes recording this expense or saving the receipt, you would have saved $8.06 in taxes in 1/12 of an hour of work. Or, put another way, a savings of $96.72 per hour. And that kind of savings can mean a lot to any struggling company.

Giveaway: I have five copies of The Tax Lady’s Guide to Beating the IRS to giveaway. To enter, leave a comment on this post with your best tax tip, describing why you really need some tax help, or just say hello!