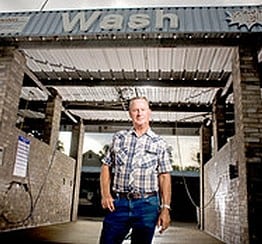

Five years ago, car-wash owner Orman Wilson set up a pension plan for himself and six employees. For that, he may owe the IRS a $1.2 million tax penalty.

Mr. Wilson, the owner of 19 coin-operated car washes in Houston, says he relied on four advisers, including a certified public accountant, to set up a plan that received approval from the Internal Revenue Service. Then, in late 2007, the IRS found fault with the plan and assessed it $250,000 — plus special penalties of $1.2 million.

The penalties “would wipe us out,” Mr. Wilson says.

Hundreds of small-business owners have been hit with similar penalties in connection with pension or benefit plans, says Alex Brucker of the Small Business Council of America, an association representing small firms on pension, tax and health-care issues. Hundreds more are likely to get hit with these penalties in the near future, he says.

All are anxiously awaiting relief from Congress, where alarm about the penalties’ impact came to a head this summer. In June, Senate Finance Committee leaders Charles Grassley and Max Baucus issued statements saying they hope to change the law that mandated the fines. They also asked the IRS to stop collections of the penalties because they were threatening to throw small-business owners like Mr. Wilson into bankruptcy. In July, the agency agreed.

Photo by WSJ.