Don Poffenroth paged through a magazine on a flight several years ago when an article grabbed his attention: Entrepreneurs could use 401(k) savings to start a business without getting hit by taxes and early-withdrawal penalties, according to a story in USA TODAY.

He and a partner had drawn up plans for a gin, vodka and whiskey distillery in Spokane, Wash., but they struggled with the best funding options.

“Neither of us was rich,” he says. “We didn’t want to have to sell shares in the company to start with. But we both had long corporate careers, and so our 401(k) plans appealed to us.”

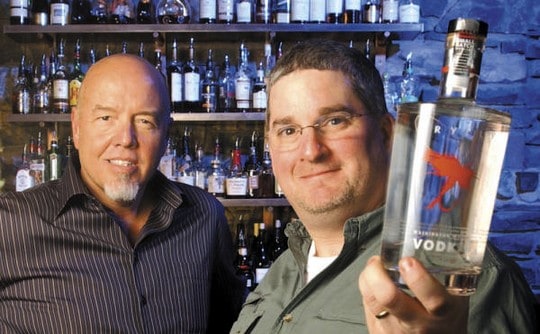

Poffenroth and Kent Fleischmann used their 401(k) savings, a working line of capital from a local bank and additional personal savings to fund Dry Fly Distilling in 2007.

Risking their retirement nest eggs has paid off so far: Dry Fly Distilling has garnered national and international awards, and its products are sold in 19 states and several Canadian provinces. Business doubled last year, Poffenroth says. Their 401(k) funds were converted to company stock as part of the start-up, and the stock value has doubled as the $2 million firm has grown.

Continue Reading: “Entrepreneurs Turn To 401(k)s To Fund Start-Ups”

Photo by Seattle Biz Journals.