Need to know where the stock market is going? Do as the pros do and search through Tweets.

USA Today reports there is a new trend rising among the people who work on Wall Street. They are using computer programs to analyze the messages posted on social media websites to determine how well a stock is going to do.

Human emotions, such as greed and fear, have always moved markets. Money can be made betting with or against the crowd, so measuring the mood of the masses online can be just as valuable as tracking price-to-earnings ratios, corporate profits and interest rates. The new trend on Wall Street for deciphering if the populace and investing public is in a positive or negative state of mind is computer-driven text analysis of the millions of real-time tweets and posts that flood social-networking sites.

Online surveillance of social-networking sites is emerging as a must-have tool for hedge funds, big banks, high-frequency traders and black-box investment firms that run money via computer programs. The goal: to gather market intelligence from previously untapped sources.

This emerging tool works something like this: Are you feeling glum, fearful or anxious today? Or are you in a calm, happy, optimistic mood? If you share your state of mind with the digital world via a tweet on Twitter or a soul-baring post on Facebook, Wall Street probably knows how you — and millions of other people — are feeling, too, thanks to its growing use of linguistic analysis of online posts. This incoming psychological snapshot of the Twitterati, digerati and average Joe could prompt a computer program interpreting the data at a hedge fund to place a trade without human intervention in an attempt to profit from the information.

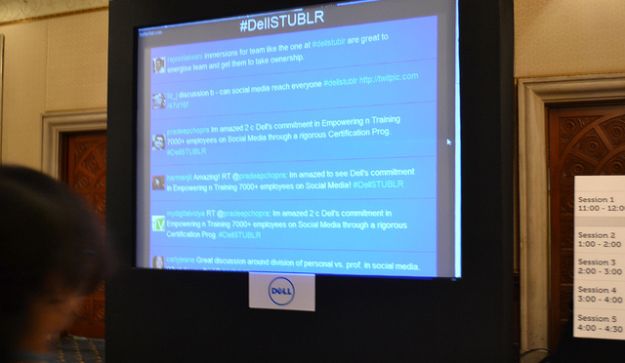

Photo by Dell