Income Assure is a private insurance company that sells supplemental unemployment insurance so that you can maintain 50% of your income if you lose your job.

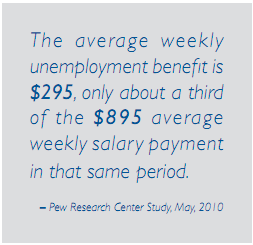

Though state unemployment systems are designed to replace 50% of former wages, benefits are capped at a relatively low fixed dollar amount. So, once you earn above a certain level, you do not reach the intended 50% wage replacement. Faced with a cash crunch, and without adequate salary replacement, displaced workers are often forced to make difficult choices and tradeoffs. Should I buy groceries or pay the utility bill? Will I default on my mortgage or delay retirement by dipping into my 401(k) account? Will I be able to help my child with college tuition?

IncomeAssure solves these problems. It is the first supplemental unemployment insurance policy of its kind in the U.S. In the event of involuntary unemployment, IncomeAssure will restore you to 50% of your former wages, providing financial protection and peace of mind.

Sample premiums:

- Construction: $62.20 per month

- Leisure and Hospitality: $39.73

- Manufacturing, Durable Goods: $37.35

- Financial Activities: $20.17

- Education and Healthcare Services: $15.05

- Public Administration: $12.23

How Long Does it Last?

IncomeAssure aligns with the state unemployment benefits system, which pays benefits over 26 weeks. There is a mandatory elimination (waiting) period of two weeks for any new claim, after which IncomeAssure pays for the remainder of the 26 week state period, or up to 24 weeks of benefits