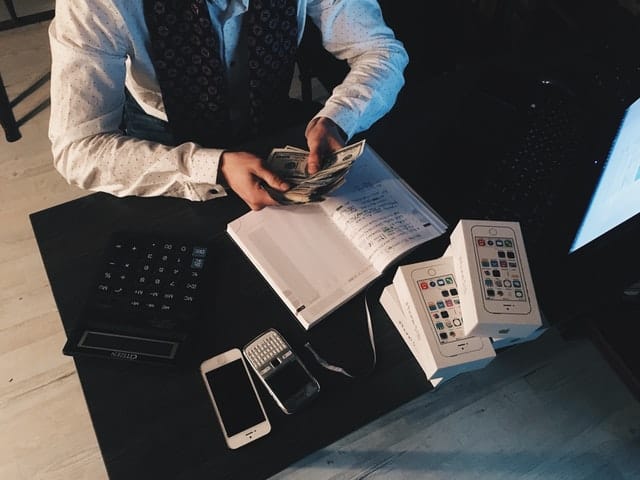

Only 4 percent of small businesses will last 10 years, according to statistics cited in Inc.com. As any small business owner will tell you, a key reason is that it can be so difficult to raise capital.

There is nothing more frustrating to a small business owner than having to secure capital in order to properly offer their service or product to the market.

This can be especially true when you are convinced that the market will support your business.

Perhaps you need capital to hire more employees, pay fixed operating costs, or invest in research and development. Whatever it is, capital is often what separates successful small businesses from those that fail.

This article will help small business owners consider various solutions to raise capital. It will also advise readers of steps to take in order to improve their chances of raising that capital successfully.

Get Your Credit in Order

There is a distinct difference between business credit and personal credit. While both types of credit are generally influenced by the same factors, personal credit is often better established than business credit when it comes to small businesses. That’s because your business will only have its own credit score after you have incorporated and obtained an EIN (employer identification number) for it.

In the early days of your business, it might be difficult for your new business to obtain a loan due to the fact that your business does not have an aged credit history. However, you might be able to secure a personal loan instead, if you have good personal credit.

For those thinking that “fixing my credit” is in order, you might be right. That’s because securing a personal loan that is sizable enough to have a noticeable effect on your small business’s performance will require a strong score in most cases.

RELATED ARTICLE: 5 STEPS TO BUILDING A ROBUST BUSINESS CREDIT PROFILE

Consider Renovating Your Home to Increase Its Value

Another workaround for small business owners who are unable to take out a traditional business loan is to refinance their home. Of course, this is assuming that you are a homeowner rather than a renter.

But in order to ensure that the refinancing offers a meaningful amount of money, do a few home improvements to increase the value of your home first.

For example, kitchen and bathroom renovations have been shown to significantly improve the value of most homes. Additionally, beautification projects from an eco-friendly lawn care company can, in some cases, increase the value of your home.

Test the Market with an MVP to Prove Interest

If your small business has a limited history, you will make a better case to a lender or an investor by showing a positive response from the market.

The best way to do this is to build an MVP (minimum viable product or service). Offer the MVP to your target audience and record the response. A successful example of this, albeit on a larger scale, is Tesla. The company announced intentions to build the Model 3 and collected more than 400,000 pre-orders before they built a single car.

With proof that the market was tremendously interested in the Model 3, the company was able to raise more than $1 billion from investors.

Small business owners can try a similar tactic. With pre-orders, or some other form of commitment in hand, you will find it easier to raise capital.

Establish a Reliable Sales Track Record

The best way to raise money is to show prospective participants genuine proof that your business can turn a profit.

Demonstrating demand is better than simply having a concept. And it is even better if you can show real sales to banks or other investors.

As a small business owner, an early priority should be finding initial traction. This could mean that you will need to customize your products or services or offer discounts. However, it is better to acquire customers early on, even if they are not your ideal customers.

Conclusion

The business world is generally not a friendly place to small businesses. Statistics show that most small businesses will not make it past the first 10 years of existence. Small business owners who are able to raise capital to support growth will likely be more successful.

To raise capital, make sure that your personal and business credit are in good shape. Also, consider making home improvements to get better home financing terms. Finally, work hard to establish initial traction in the market.