Featured image by AlexanderStein from Pixabay

While mental health is important, employees’ financial situation is equally as important not only for their wellbeing but also for the prosperity of your company. Having poor mental health and financial wellbeing can have a serious impact on the productivity of employees.

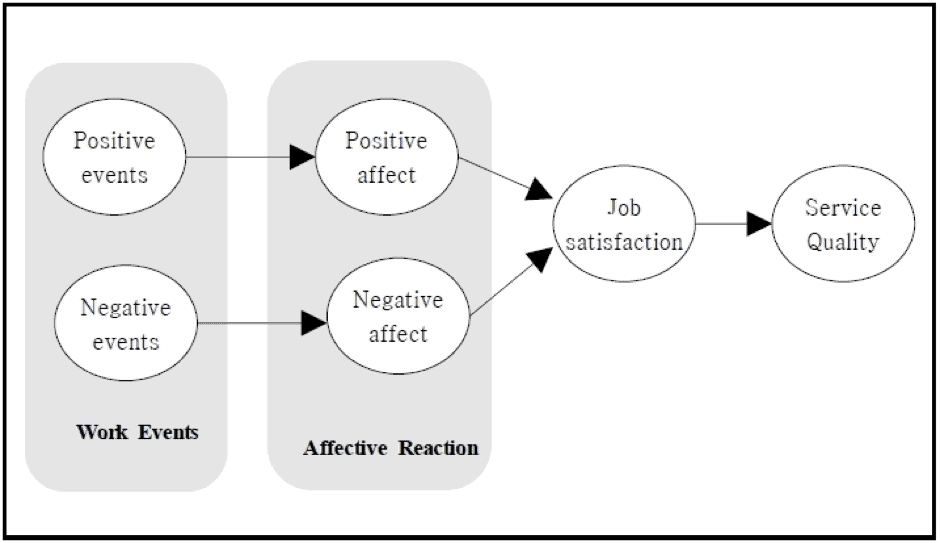

An Affective Events Theory (AET) explains how job performance depends on the feelings and emotions in the workplace.

If you are worried that your workers might be feeling worried or losing sleep because of financial matters, here is what you should consider for your business not to get affected.

Why Employees’ Financial Wellbeing Matters

Many people are losing sleep or feel constantly anxious about their financial disruptions. They need to think about paying the bills, covering all costs, saving, or planning for retirement.

Some employees are constantly deep in debt, others try to find the best short-term loans to get one more loan and not to overpay. The main reason for being in that endless cycle is a lack of financial literacy.

The responsibility for financial matters recently shifted from the state and recruiters to the employees themselves. However, workers seem to lack financial education and aren’t sure how to make smart financial decisions.

If your employees aren’t informed about their financial choices or unconfident in their actions, your business can be affected as well.

A whopping 80% of American employees spend between 12 and 20 hours a month dealing with financial concerns at work.

If you want your company to expand and bring even more profit, you need to think about the financial wellbeing of your employees. Helping them obtain the necessary education to boost their financial literacy is significant and should become your top strategy.

Many businesses concentrate on other perks and benefits while believing financial education is not important. Yet, allowing your workers to improve their knowledge in the financial sphere and get rid of certain concerns or issues can lead to better performance and higher productivity.

You should keep in mind that the age of your workers also matters.

A recent graduate might be focusing on repaying a student loan and climbing the career ladder. A middle-aged worker is usually struggling with supporting the family and paying down the mortgage. An older person might be worried about retirement savings. Depending on the age of your employees, the way you try to help them should vary.

RELATED ARTICLE: WHEN IS THE RIGHT TIME TO TEACH KIDS FINANCIAL SKILLS?

The Side Effects of Financial Stress at Work

According to the American Institute of Stress, only four in 10 employees who report stress to the boss get some kind of help. Typically, a recruiter would offer a stress-management class (22%) or refer to a mental health professional (26%).

What if employers started caring more about the financial and mental well-being of their workers? It will definitely benefit their businesses in general and help each worker be more focused and organized.

“For so many employees, financial stress is the number one cause of their permanent stress, ” says Robert Stewart, HR administrator at the Brigham Young University of Idaho. “If a worker has difficulties paying bills or has a mountain of debt that needs to be repaid, he or she will look at how an employer takes care of them. If they are not treated the right way and their finances don’t improve, they may quit.”

Some recruiters aren’t aware of such issues in their workplace. However, just because you are unaware of it or employees hardly report such problems to you doesn’t mean they don’t exist.

Financial stress is real and it can affect the worker’s health. Specialists admit that permanent stress over money matters can lead to anxiety, migraines, sleep deprivation, and even depression.

As a result, such health issues of your workers will inevitably have a bad effect on their performance as many workers suffer from absenteeism and are less self-organized.

While having health insurance and retirement savings is essential for the wellbeing of your employees, getting them a decent financial education is just as important.

RELATED ARTICLE: CREATING AN EMPOWERING WORKPLACE ENVIRONMENT

Ways to Improve the Financial Wellbeing of Your Employees

Many businesses often neglect these issues because of privacy.

Employees can feel intimidated to talk about financial problems and few people will honestly tell you they are nearly bankrupt when you ask them how they are doing.

Don’t wait until it’s too late and your business starts to suffer. Here are some of the best ways you can help your staff become more financially literate.

1. Craft the Right Program for Each Employee

One tip won’t solve the financial matters of every employee in your company. Each person has individual needs or disruptions. You can make anonymous polls to find out the truth about the financial situation of each worker separately. This is a great way to gather information since many people are embarrassed to discuss such matters in person.

Apart from health insurance or regular 401(k) some employees have specific concerns and financial needs.

2. Invite an Expert

Have you notice you can’t cope with all your workers yourself because each of them has a specific issue or a certain financial problem? Invite a financial wellness specialist or even a separate company that specializes in handling such matters. It is a great long-term investment in the financial education and overall well-being of your workers and thus your company.

As a result, every employee will get attention and talk about private financial disruptions or ask for professional advice on how to manage personal finances better. There are many consultants and financial coaches available these days. They can share expertise and educate your employees on various finance-related topics.

3. Concentrate On Overall Stability and Wellness

It’s rare that financial stress comes unaccompanied. It is often combined with other types of stress and anxiety. As a result, every aspect of an employee’s life suffers and there is no work-life balance.

As a recruiter and a business owner, it’s your duty to improve the wellness and stability of all your workers. It’s a perfect time to improve the situation and make sure every employee knows how to manage finances, how to get out of debt, and how to take care of all aspects of their lives.

If you find time and resources to create a comfortable working environment for your staff, the employees’ productivity and motivation will increase.

RELATED ARTICLE: HOW TO KEEP EMPLOYEES CONNECTED IN THE WORKPLACE

Final Thoughts

In conclusion, if you decide to help your workers manage personal finances and boost financial literacy, you will make a long-term investment in your own company and workforce. There are obvious benefits and positive effects. Benefits not only for the personal lives of your staff but also for the development of your venture.

This way you can protect your company from potential losses and issues caused by stress and improve the corporate brand.