Featured image by LookerStudio

Algorithmic trading has been around for a while. It is a trading strategy that uses mathematical rules to automatically trade stocks, futures, and other assets to generate returns on investment or reduce market risk.

Trading has always been a struggle for anyone who doesn’t have the necessary knowledge and skills. However, one of the benefits of algorithmic trading is that it helps traders maintain their edge in the market. Algorithmic trading is compatible with real-time financial data streams. It can be updated instantly. The algorithms are set to monitor price fluctuations and invest accordingly. Therefore, traders don’t have to monitor the markets continuously.

Here are ten reasons why algorithmic trading is profitable.

Algorithmic Trading Is Easy to Set Up

Setting up an algorithmic trading system is much easier than manually monitoring the markets. When you’re first starting as a trader, it can be difficult to juggle all the different aspects of the market. However, you do not need to take care of each detail yourself when you’re using algorithmic trading. The software does it for you. You only need to input your parameters and then let it run its course. That way, you can focus on developing strategies instead of managing every little detail.

Moreover, there are special algo trading communities where you can start the journey by finding a ready-made robot. Or you can find a contractor for implementing your unique strategy. One of the biggest trading communities is MQL5.Community. Here, people can discuss and sell algo trading software. It also features a variety of other useful services.

It Allows for Automated Trading

The automated nature of algorithmic trading is one of its biggest benefits. Traders don’t have to sit in front of their computers all day and monitor the markets themselves. This means traders can spend time on other tasks like managing their portfolios and researching.

It also minimizes risk. This is because traders don’t need to constantly watch the markets. Instead, they can leave it up to the algorithms. It takes away much of the responsibility and stress that come with trading, which is why many people avoid the market. They’re simply not confident in their skills.

RELATED ARTICLE: MANAGING FEAR AND GREED WHEN YOU INVEST IN CRYPTOCURRENCY

Algorithmic Trading Gives You Trading on the Go

One of the major benefits of algorithmic trading is that traders can trade from anywhere. Traders who travel for work, for example, can set up automated investing processes to make trades in their absence. This means they can virtually trade from their hotel room or remote office. This also makes it easier for traders to maintain a global presence because they can access the markets from anywhere in the world.

Another aspect of algorithmic trading is cloud testing. It is important to note that a proper cloud network enables fast optimization of trading robots. This is because such a network allows access to the processing power of thousands of computers all over the world.

For instance, the MQL5 Cloud Network is a service that enables remote agents of MetaTrader 5 to collaborate and distribute tasks among themselves. With additional processing power, it can run thousands of tests in only a few hours.

There Is Less Risk of Manual Human Error

One of the most important benefits of algorithmic trading is that it helps reduce the risk of manual human error. Human actions are imprecise. This imprecision can lead to errors in trading, such as misreading charts or entering orders at the wrong price.

There’s a special term in trading: Fat Finger Error. It’s a unique type of trading mistake that can have a significant effect on the market. For instance, if a trader mistakenly enters 1,000,000 shares of Apple Inc.—instead of 1,000—at the market price and proceeds with the sale, the order could affect the entire market.

Algorithmic trading, on the other hand, follows a predetermined set of instructions in order to trade efficiently. Programs are designed to avoid both systematic and random errors when executing trades.

Additionally, algorithmic trading also helps traders avoid emotional decisions. For example, if the market is going up and you have been watching it go up for hours on end, you might be inclined to invest. But entering at the top of the market can result in losses. There is no emotion involved with algorithmic trading. Your trades will occur based on predetermined conditions. This helps mitigate risks and maximize profits.

You’ll Get Software Updates in Real Time

One of the benefits of algorithmic trading is that it can update in real time. By using algorithms, traders don’t have to monitor trends and financial data streams constantly.

The software does this for them. It also updates automatically according to price fluctuations. This allows traders to do other things like go on vacation without worrying about their assets. Traders can also set parameters such as stop-loss and risk values, which the software will follow accordingly. A trader’s return on investment (ROI) will be higher with algorithmic trading because they won’t need to monitor the markets all the time.

New Algorithms Are Continually Being Developed

One of the most important things about algorithmic trading is that its developers are constantly developing new algorithms. This means that traders using this method will always have the newest algorithm to use.

Moreover, the developers behind these algorithms are top-notch mathematicians and programmers. They continually strive to develop the best algorithm possible. These mathematicians and programmers are motivated to work hard because they want their algorithms to be the next big thing in the industry.

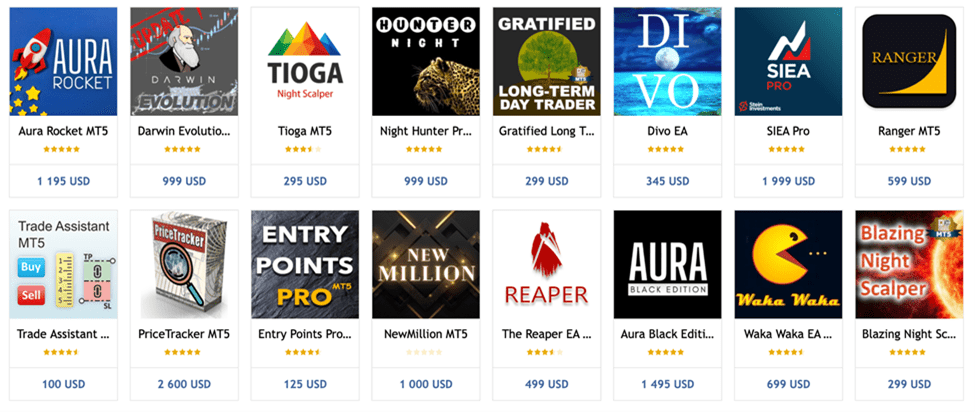

There are more than 6,000 Expert Advisors (algo robots) and Indicators for MetaTrader 5 available for purchase on MQL5.com Market. You can download and test a program that fits your conditions. The only requirement is that the program works seamlessly and has the necessary parameters in advance.

Algorithmic Trading Lets You Trade More Than One Market at Once

Algorithmic trading allows you to trade in multiple markets at the same time. Traders are often limited to one market when they use manual trading methods.

But with algorithmic trading, it is possible for traders to trade in different currencies or commodities. This allows traders to maximize their earnings by investing in various markets that offer the best profit opportunities. They will always have a market open for trading. Therefore, they can take advantage of any opportunity that arises.

RELATED ARTICLE: FOREX SOCIAL TRADING: WHAT ARE THE PROS AND CONS?

The Software for Algorithmic Trading Is Inexpensive

Algorithmic trading is accessible to everyone, regardless of their budget. There are no commissions on trades, so the software is the only cost. What’s more, most are free or have a low monthly fee, which you can pay with an annual contract.

It Gives You a Variety of Trading Strategies

Algorithmic trading offers a variety of trading strategies to choose from. Unlike traditional methods, algorithmic trading allows traders to use many different systems that are compatible with their investments.

It Simplifies Complicated Investing Decisions

One of the most attractive features of algorithmic trading is that it simplifies complicated investing decisions. This is because it uses a set of instructions to invest without the trader needing to monitor the markets continuously. This is useful for people who lack the knowledge and skillset to trade efficiently or who don’t have time to monitor their investments closely. Algorithmic trading reduces the number of decisions traders need to make because algorithms automatically take over and execute trades.

RELATED ARTICLE: DISTINGUISHING BETWEEN A REVERSAL AND A PULLBACK AS A TRADER