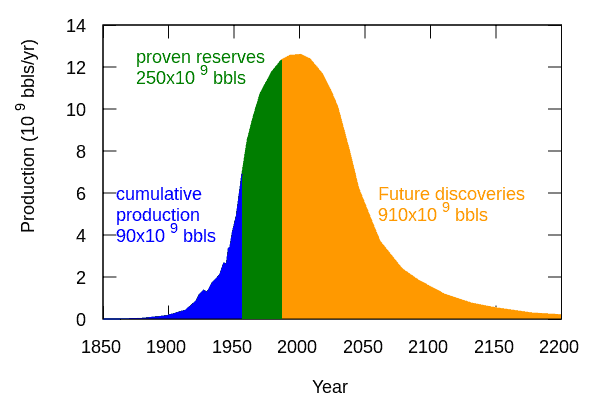

Remember Peak Oil? That was the theory that at some point soon, we would reach the point at which the rate of petroleum prodution would begin to decline, never again to reach the high point of production.

It seemed like a good theory, but according to The Boston Company Asset Management’s Global Natural Resources Team it didn’t hold up. They explain:

For decades, pundits have been trying to predict a tipping point for Peak Oil – when a sustained and unabated climb in oil prices sparks a near-collapse of the global economy. According to Peak Oil theory, the rate of petroleum extraction will crest and then begin an immutable decline, pushing oil prices ever higher as demand for this finite resource permanently exceeds supply.

However, an array of structural shifts in the Energy industry is conspiring to insulate the global economy from any such dramatic increase in the price of oil. After decades of indifference, pivotal U.S. consumers have radically altered their consumption of petroleum and related products, moderating demand for the world’s largest market. Concurrently, heightened investments and technological breakthroughs have spurred an explosion in resources, as source rock has expanded the definition of “finite resource.â€

Although the Earth will not yield any more resources from decaying dinosaurs and vegetation any time soon, the planet already has more than it will ever need. Just at a time when consumers are finally thinking about consumption and exhibiting price-elastic behavior, horizontal drilling is accessing resources previously thought to be inaccessible. This has led to a dearth of global capital spending and allayed our concerns about demand outpacing supply.

End of an Era: The Death of Peak Oil An Energy Revolution, American-Style