Anyone running a small business knows how hard it can be to get that cashflow working for you. There are many challenges that need to be tackled. There are practical, common sense methods to help keep that cashflow on track though. Here are some top tips to help keep your cashflow moving in the direction that you need it to.

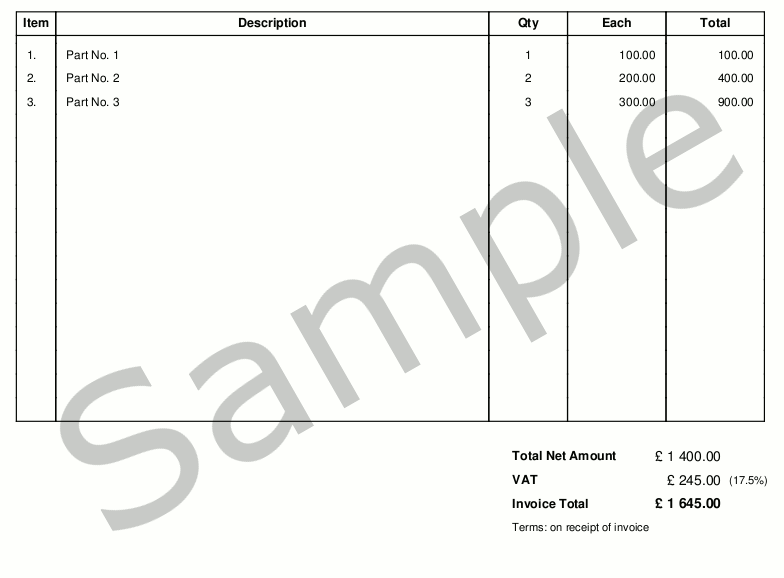

Keep On Top Of Your Invoicing:It is important to invoice quickly in order to get your payments on time. It should be obvious to anyone that delays in issuing an invoice to a client will result in later payment. The payment terms should be agreed up front with any new client so that everyone knows where they stand and how long they have to pay. This way everyone knows what to expect and your business knows when it can chase outstanding payments. Invoicing by email is a quick and easy way to issue invoices and you have a record that they have been sent and can alert yourself to any action necessary when payments become due. There are always occasions where payments become overdue so have a back-up plan to cover gaps in cashflow. Take a look at business finance companies who can help keep those cashflows moving with practical finance solutions. For help and advice take a look at ultimatefinance.co.uk.

**Create Practical Payment Arrangements: **

All companies experience gaps in their cashflow. Making payment of invoices as easy as possible for your clients will mean that it is better for both parties. Use payment methods such as Direct Debit which require minimal effort from your clients where you can. Cheque payments create their own delays and are often used by companies for this reason. Try to use online payment methods where you can and avoid cheque payments which require time to clear after they are received. If you are able to offer a fixed fee service that means you know how much you are charging a customer each month and can bill accordingly it makes it much easier for both parties to manage.

Take Advantage of technology:

There are many packages around these days that business can take advantage of. These manage everything from invoicing to accounting. If you do not have the in-house capacity to run your own software, there are several cloud-based accounting packages out there which many businesses find to be practical and efficient. It also means that invoicing and accounting can be completed anywhere at any time without the need to worry about regularly backing up data and storing it. This is all done for you so saves both time and money.

Ensure that someone in your business is responsible for the cash-flow and keeps an eye on it on a daily basis. It is easy to drop the ball and get caught out. Keeping on top of your finances and having a plan means that you know what to do when things come unstuck, which at some point is inevitable. Financial strategies are key tools – so use them.