When is The Right Time to Teach Kids Financial Skills?

Kidworth.com believes it is never too soon and they have a method to help you teach them.

The following is a guest post by Rudy DeFelice of Kidworth

As a father of three and founder of Kidworth, Rudy DeFelice is familiar with the issue of when parents should start addressing kids financial literacy. The answer may surprise some. Here’s a hint: most parents don’t start early enough. Given uncertain economic conditions, the rising cost of education and threats to many government programs and it has never been more important to get it right..

Few would argue that financial literacy is an important life skill. But when should parents start shaping their kids relationship with money, and focus on helping kids develop the skills and habits that will serve them throughout their lives? The answer: sooner than you think.

In our experience in dealing with families, we find that by around age four, children start to show an appreciation of the basic principles of money and value. Signs you can look for to help you determine if a child is ready to grasp financial conversations are:

- Does your child grasp the fundamental concept of ascribing value to a symbolic instrument, i.e., coins, bills, toys? If yes, the child is ready to talk about how an item is purchased with money, and how many coins or dollars it will take to purchase something. If this is a conversation a parent is having on an ongoing basis, the child begins to understand the relationship between money, goods and value.

- Does your child understand the principle of growth over time? For example, do they understand that individual coins placed in a piggy bank accumulate over time? If so, the child understands the relationship between time and growth.

- Does your child understand the basic relationship between money, wealth and lifestyle? Around age 4, kids start to notice that the people in their lives lead different lifestyles relative to their financial position. This is a natural observation, and indicates an understanding of the impact money can have on peoples lives. This is not a question of values about wealth, but more of a test to see if kids understand the relationship between money and lifestyle.

- Does your child understand the simple mechanics of currency, (such that five of one coin can have the same value as one of another, for example)?

If you are answering yes, then it just may be time to start teaching your children the values of money – especially when it comes to saving and planning.

Many families consider financial literacy as something like calculus, that you start learning at a certain age. However, that is a mistake. Calculus is a tool to exercise problem solving skills important to learning higher mathematics. Financial literacy is a fundamental tool for living, which is in part skills driven, in part values driven. In that sense, it is more like nutrition, religion and the basic principles of social interaction (courtesy, sharing, etc.) and it should be part of families conversations at an early age.

https://www.business-opportunities.biz/2017/09/18/move-to-another-city-painlessly/

That means that financial literacy is something kids learn from and with parents by exposure, over the course of their whole lives. It is one of the basic responsibilities of parenting. Over time, exposure to the system leads to natural absorption of the principles, similar to the way children learn language. If parents want kids to become adults with good financial habits, they should help them develop these habits naturally over the course of their lives.

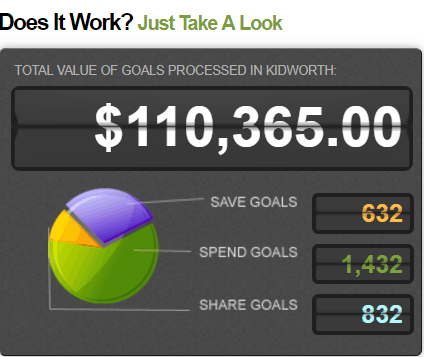

Kidworth has just the ticket. Instead of children receiving thousands upon thousands of dollars in the childhood for birthday, holiday and other gifts, Kidworth offers an incentive for them to get gifts of money instead. From there they can learn to save that money, watch it grow and plan for purchases they will indeed want as the years go on. It is a great site and worth checking out.

https://www.business-opportunities.biz/2017/09/27/becoming-your-own-boss-2/

https://www.business-opportunities.biz/2017/09/20/emotions-investing-mistakes/

https://www.business-opportunities.biz/2017/10/01/immediate-financial-crisis/

https://www.business-opportunities.biz/2017/07/06/launching-dream-business-tips/