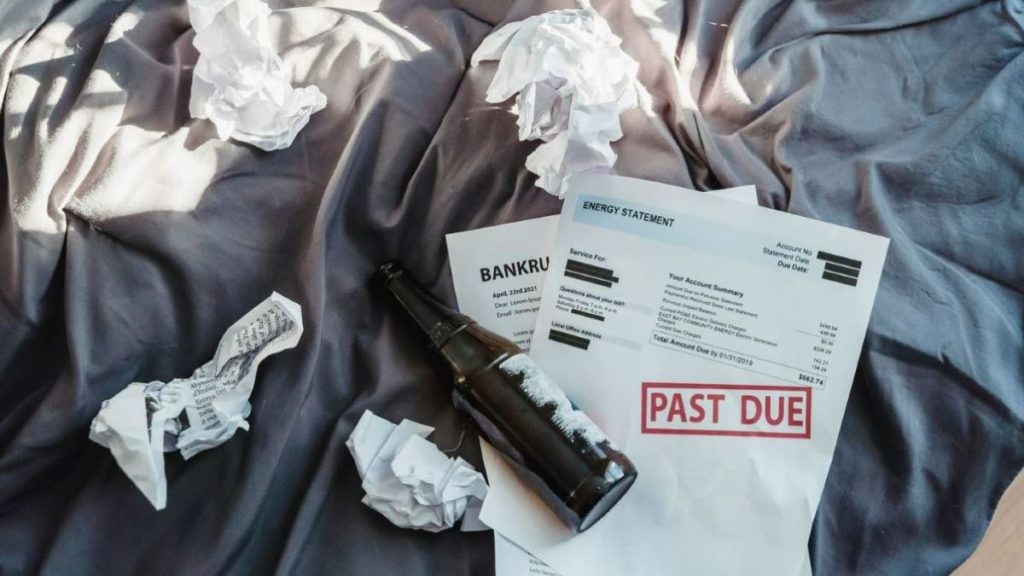

Featured image by Nicola Barts via Pexels

Many people find it difficult to save money. For some, the inability to save money has nothing to do with a lack of financial knowledge or a pattern of reckless spending. Instead, it may result from unpredictable expenses and inconsistent paychecks. This pushes people into dipping into their meager savings to cover immediate needs like rent, utility bills, and unexpected expenses.

Moreover, if you’re trying to start a small business, a lack of savings can keep you from making the changes that will help it thrive. This can lead to a hopeless cycle that seems to have no end.

RELATED ARTICLE: IS IT TIME TO EXPAND YOUR SMALL BUSINESS?

For another example, if your car needs urgent repairs, you may have to use the money you hoped to save. This can be especially urgent if you use your car as your office.

If you own a car but have trouble saving money, consider taking advantage of options such as extended car warranties. You can describe such warranties as car service contracts. To find the best car warranty companies in your area, check out a CarShield Review to determine the benefits, exclusions, and plans.

In business and life in general, people are always looking for ways to reduce their expenses and save more money. That is especially true in the current economy. Most people could use some clever money-saving ideas right now. After all, the pieces may fail to come together even for hardworking, knowledgeable, and intelligent individuals.

The Struggles of Living Paycheck to Paycheck

Living without savings is not living. Instead, it is a struggle to survive. If you must wait for payday to meet your basic needs, your stress levels are probably higher than for those who do not have to wait for payday to enjoy life. Some of the disadvantages of living paycheck to paycheck include:

Being Financially Unprepared for Emergencies

One of the biggest struggles of living without savings is that you will be ill-prepared for unexpected expenses. After all, saving for a rainy day is not a priority for those who live paycheck to paycheck. When an emergency arises, you may quickly face financial ruin.

For example, an expensive home repair, medical emergency, or car repair can force you to fall back on your credit cards. Your credit cards may help you out of a financial jam. However, after the emergency, you will have higher credit card payments to fit into your tight budget. That is no way to live.

Having to Borrow From Family or Friends

If you do not have credit cards, you may have to borrow from family and friends to avoid financial ruin or even homelessness. That is the last thing anyone would want. You do not know what obstacles life will throw your way. Knowing that you are ill-prepared for such financial obstacles will only add to your daily stress.

Dealing with the Increasing Cost of Life Without Savings

The current economy and job market being what they are, you are probably grateful to have a job. After all, the cost of gas, food, and other basic needs seems to rise yearly. Without savings, even if you do everything possible to downsize your life, you may still find it difficult to survive. The struggle to stretch each dollar is only getting more challenging, and many people do not see the light at the end of the tunnel.

RELATED ARTICLE: 4 POWERFUL COST-SAVING STRATEGIES FOR STARTING A NEW BUSINESS

Falling into a Cycle of Debt with No Savings

Whether you have savings or not, emergencies can still happen. When you are living without savings or an emergency fund, your only option may be to take out a loan to meet unexpected expenses. Unfortunately, borrowing money to meet unforeseen costs will only add more pressure to an already desperate situation. You will likely have to borrow even more to pay older debts or keep lenders at bay, resulting in a never-ending cycle of toxic debt.

The Woes of a Bad Credit Score and No Savings

When you are broke or in debt, a bad credit score might keep you in your cycle of debt. The more you overextend your finances, the lower your credit score will sink. That will make it difficult to get ahead by starting a business or getting a better job.

For example, if you have a bad credit score, you can also forget about applying for a bank loan to start a business. A battered credit score can disqualify you from all but the worst borrowing rates. Furthermore, it can increase the risk of default, foreclosures, bankruptcy, eviction, and even homelessness.

RELATED ARTICLE: HOW TO KEEP UP WITH YOUR BUSINESS AS A SINGLE PARENT

How to Stop Living from Paycheck to Paycheck

Of course, conventional saving advice does not work for everyone. According to one study, the households polled said they typically use about 72 percent of their savings within the next six months. Due to the short-term nature of their savings, families with inconsistent paychecks need to understand two essential facts. First, paychecks may vary widely. Second, expenses are constantly in flux.

If you live without savings, you should track where your money is going. Once you understand your spending habits, you will almost certainly find waste. You can reduce the pressure on your financial situation by cutting waste.

Also, budgeting can give you a lot of breathing space. Create a spending plan and budget to eliminate waste, identify trouble spots, and increase savings. Analyze your fixed expenses to determine where you can make some savings. For example, you can save some money by getting a cheaper car insurance policy. You can also save money by cooking at home more often than eating out.

These adjustments may seem relatively insignificant. However, they can quickly add up. If you are living paycheck to paycheck, this is the kind of breathing space you need to start taking control of your future.

If you can break your toxic debt cycle, your life will get a whole lot better. Finally, it is worth noting that living paycheck to paycheck will rob you of the ability to be generous to causes you care about and people in need.

The Bottom Line

Nowadays, even the rich are having trouble getting by. According to one study, about 61 percent of Americans live paycheck to paycheck. Furthermore, 36 percent of these are high-income individuals with an annual income of more than $250,000. Financial disaster is a real possibility, whether you earn too little, spend too much, or some combination of both. Now is the time to make changes.

RELATED ARTICLE: 3 STRATEGIES FOR MANAGING YOUR BUSINESS FINANCES