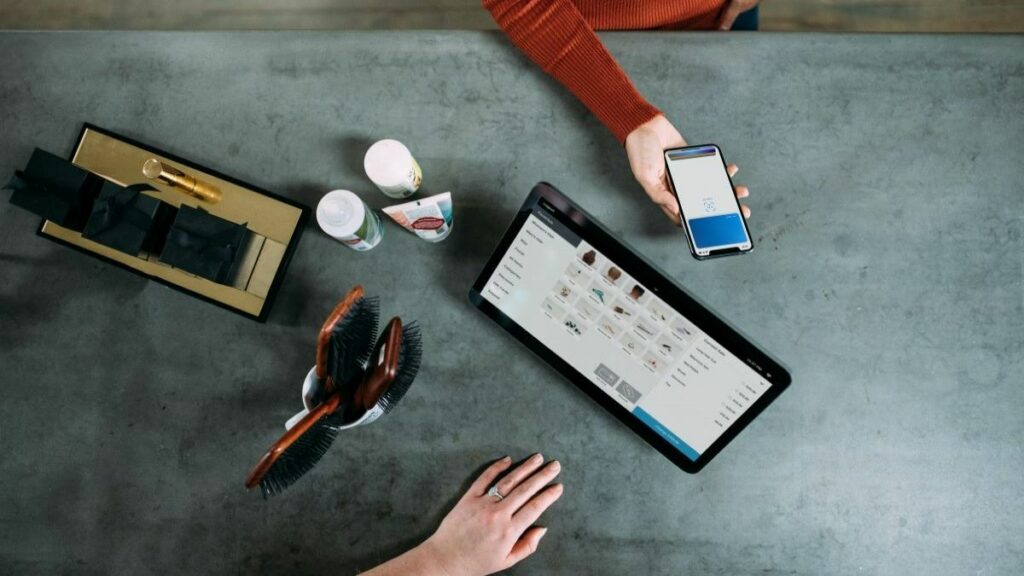

Featured image by Blake Wisz via Unsplash

Merchant account services is the term for the processing of credit and debit card payments for both in-store and online sales. There is a difference between a high risk merchant account and a standard or low risk merchant account service.

Learning more about merchant accounts in general and what type of account your business needs is a great way to ensure that you keep your business moving forward. Knowing what you need will allow your business to have stable cash flow and give you peace of mind. Moreover, if a customer should dispute a transaction, you will know that you can easily manage the situation with the help of your merchant account services.

What Are Merchant Account Services?

A merchant account is a type of bank account that gives businesses the ability to accept payment by debit or credit card. Merchant services can include all the hardware, software, and technical support that allows a business to provide these payment processes.

The merchant account is an agreement between the business, the merchant bank, and the payment processor. Once the account is set up, the payment process works by issuing and acquiring funds to process the payments.

Are We Heading for a Cashless Future?

As more and more of us use our debit and credit cards to make payments for all manner of goods and services, it is easy to see why a merchant account service is so important. In fact, every business needs some way to process payments, no matter how small or big the company is or what type of industry it is in.

Moreover, most people and companies are going cashless or planning to in the next few years. Your business must have the ability to process credit and debit card payments. You also need to acquire NFC technology for taking payments over people’s mobile phones. If your business remains without these technologies, your competitors will leave you behind. Your business might even be unable to function at all.

RELATED ARTICLE: 3 STRATEGIES FOR MANAGING YOUR BUSINESS FINANCES

What Are the Different Types of Payments Merchant Account Services Can Handle?

There has been a significant increase in the different payment options customers can use to pay for goods and services.

This is thanks in large part to the COVID-19 pandemic. March 2020 marked a clear change in how people paid for items. This was the first time that card-not-present transaction volume was higher than card-present. Moreover, this statistic has never returned to pre-pandemic levels.

Consumers have now adjusted to alternative payment methods instead of cash. As evidence, 39% of people now shop from a smartphone daily or weekly, and 23% shop this way daily. This means merchant account services are more important to businesses than ever.

Today, Apple Pay and Google Wallet make it easier than ever for consumers to use their phones to pay for things. Hence, it is important that a business has the function that a merchant account service provides, whether the business needs a high risk merchant account or a standard one.

Payment types include:

Credit Card Processing

Debit and credit card processing allows for customers to make payments using their cards instead of cash. There are different fees and charges depending on the type of merchant account services your business has.

Point-of-Sale Processing

Point-of-sale hardware and software enables a business to sell to customers who wish to check out online as well as to those who want to pay at a retail counter. With this process you can accept payments, manage your team, and track sales.

Virtual Terminals

A virtual terminal accepts transactions using a computer rather than a physical card reader. You can charge customers, itemize sales, and take a one-off payment or set up a recurring payment schedule.

Loyalty Schemes

Gift cards and loyalty schemes attract new customers and grow a customer base. Having a system in place that can accept gift card payments is crucial to increasing sales and enhancing your connection with your customers.

BACS

Bankers’ Automated Clearing System (BACS) is a network for electronic payments. The process allows for money to be transferred from one bank account to another. Businesses sometimes offer BACS as a payment option.

What Are Some Benefits of Using High-Risk Merchant Account Services?

There are a few benefits to accessing a merchant account as a business. But the main thing is that it offers great flexibility and a solid foundation from which you can grow. This is true whether you are looking to sell items online, in store, or combine the two.

Safety with High Risk Merchant Account Services

High risk merchant account services are a requirement for any business that banks deem a financial risk. A high risk merchant account helps to boost safety, preventing chargebacks and increasing safety procedures designed to prevent fraudulent activity.

RELATED ARTICLE: CHOOSING THE BEST EWALLET FOR YOUR BUSINESS

Flexibility with High Risk Merchant Account Services

A high risk merchant account allows a business to accept payments in different currencies. This gives a business the ability to accept international payments. This in turn allows a company to grow its potential customer base.

Conclusion

A high risk merchant account is essential for businesses that might otherwise not have the chance to conduct business. Overall, this type of merchant account allows such businesses to provide their customers with a flexible array of payment options while also guarding the business against fraudulent activity.

RELATED ARTICLE: WHAT IS A CHARGEBACK AND HOW WILL IT AFFECT YOUR BUSINESS?