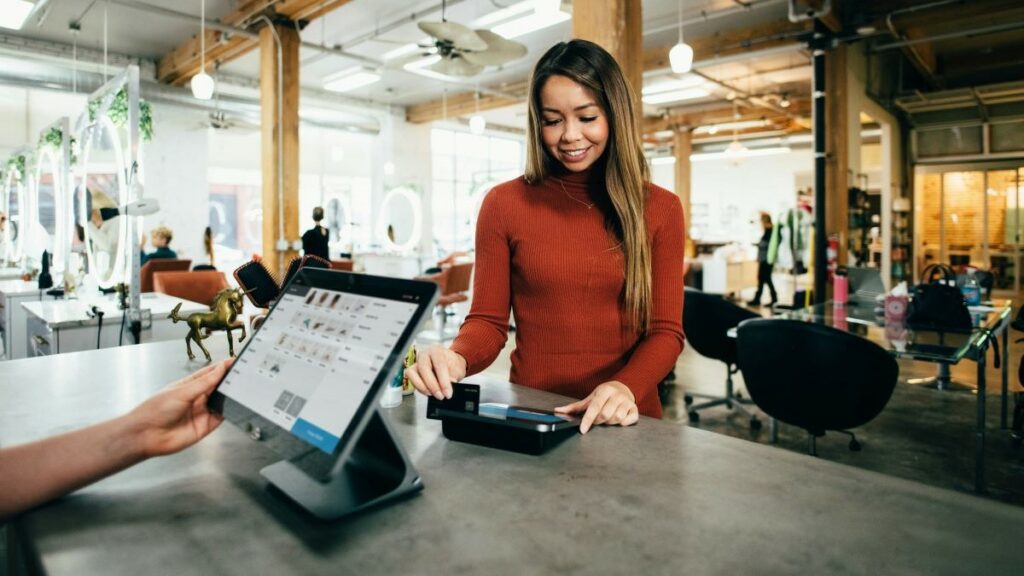

Featured image by Blake Wisz on Unsplash

The dynamic food and beverage (F&B) industry makes efficiency and convenience paramount for businesses and customers. Therefore, as your consumers’ preferences evolve and technology advances, streamlining payment processing for your F&B establishment becomes critical to your operational success.

This article explores the benefits and innovations shaping payment processing in the F&B sector and how your business can leverage technology to enhance transaction experiences.

RELATED ARTICLE: HOW TO ATTRACT MORE CUSTOMERS TO YOUR RESTAURANT: 6 TIPS

Benefits of Streamlining Payment Processing in the F&B Sector

Streamlining payment processing in the F&B industry offers numerous benefits for your F&B establishment and its customers. Optimizing the payment experience enables your F&B establishment to enhance operational efficiency, improve customer satisfaction, and drive business growth.

Improved Efficiency

Streamlining payment processing reduces the time and effort required to complete transactions. This enables your F&B establishment to serve customers more efficiently. Faster checkout times and reduced wait times lead to higher table turnover rates. Therefore, your business will enjoy increased throughput and improved operational productivity.

Enhanced F&B Customer Experience

A seamless and frictionless payment experience enhances customer satisfaction and loyalty. By offering convenient payment options, such as contactless payments, mobile wallets, and QR code payments, your F&B establishment makes it easier for customers to pay for their orders. This leads to a positive dining experience as well as repeat business.

Fewer Errors and Discrepancies

Automated payment processing systems minimize manual errors and discrepancies, such as incorrect order totals or mis-keyed payment information. Similarly, integrated point-of-sale systems and payment gateways ensure accuracy in transaction processing. This reduces the risk of billing disputes, chargebacks, and customer dissatisfaction.

Enhanced Security for F&B Establishments

Streamlining payment processing with advanced security measures, such as tokenization, encryption, and biometric authentication, enhances the security of payment transactions. This also protects sensitive customer data from fraud and data breaches. Secure payment processing therefore instills trust and confidence in customers, strengthening the reputation of your F&B establishment.

Optimized Cash Flow

Faster payment processing and settlements accelerate cash flow for your F&B establishment. This improves overall liquidity and financial stability. Instant payment solutions also enable quicker access to funds, reducing the time between transactions and revenue realization. Optimized cash flow therefore enables F&B establishments to meet their financial obligations promptly and put stock into growth initiatives.

Cost Savings for F&B Businesses

Streamlining payment processing reduces transaction costs, processing fees, and operational expenses. By automating payment processes, your F&B establishment minimizes labor costs, optimizes resource allocation, and eliminates paper-based processes, resulting in significant cost savings over time.

Data Insights and Analytics

Integrated payment processing systems capture valuable transaction data and provide actionable insights into customer behavior, purchasing patterns, and sales trends. Analyzing transaction data helps your F&B establishment identify opportunities for targeted marketing campaigns, upselling, and cross-selling. This therefore enables you to make data-driven decisions and optimize revenue generation.

Regulatory Compliance

Streamlining payment processing with compliant payment solutions ensures adherence to regulatory requirements, such as the Payment Card Industry Data Security Standard (PCI DSS) and other data privacy regulations. Compliance with industry standards and regulations minimizes your risk of fines, penalties, and legal liabilities, safeguarding the overall reputation and integrity of your F&B establishment.

Seamless Integration

Integrated payment processing systems seamlessly integrate with existing POS systems, accounting software, and operational workflows, thus streamlining data management and reconciliation processes. Real-time synchronization of payment data across multiple systems decreases administrative overhead and eliminates manual data entry, improving your overall efficiency and accuracy.

Competitive Advantage for F&B Establishments

F&B establishments that offer streamlined payment processing set themselves apart by attracting tech-savvy customers who value convenience and innovation. A seamless payment experience contributes to a positive brand image and positions your F&B establishment as a leader in the industry, driving customer loyalty and market share growth.

Innovations in F&B Payment Processing

Innovations in payment processing have revolutionized how you conduct transactions in the food and beverage (F&B) industry. From enhanced security measures to frictionless checkout experiences, these innovations have reshaped the payment processing landscape in food and beverage establishments.

Notable innovations include tokenization, biometric authentication, voice-activate payments, blockchain technology, open banking, and instant payments.

Tokenization

Tokenization refers to a security measure that replaces your sensitive payment data, such as credit card numbers, with unique tokens. These tokens are meaningless to potential hackers, thus reducing the risk of data breaches and fraud. F&B establishments have therefore adopted tokenization technology to boost the security of payment transactions and protect customer data.

Biometric Authentication

Biometric authentication methods have been integrated into payment processing systems to verify customers’ identities securely. Adding biometric authentication thus enhances payment security and user experience by reducing reliance on passwords or PINs.

Voice-Activated Payments

Voice-activated payment technology lets you purchase voice commands through virtual assistants like Amazon Alexa or Google Assistant. F&B establishments are exploring voice-activated payment solutions to offer customers a hands-free and convenient checkout experience, particularly in drive-through or delivery settings.

Blockchain Technology

Blockchain technology, which enables secure and transparent peer-to-peer transactions, has also gained traction in payment processing. F&B establishments are exploring blockchain-based payment solutions to reduce transaction costs and increase transaction speeds as well as to enhance the security and traceability of payment transactions.

Open Banking

Open banking initiatives allow third-party developers to access financial data from banks and payment providers via open APIs (Application Programming Interfaces). F&B establishments leverage open banking APIs to offer innovative payment services, such as real-time bank transfers, account-to-account payments, and personalized financial management tools.

Instant Payments

Instant payment solutions enable funds to be transferred between parties instantly or within seconds, all day every day, around the clock and all year long. F&B establishments embrace instant payment solutions to offer customers faster checkout experiences, accelerate cash flow, and improve liquidity.

Contactless Wearables

Contactless wearable devices, such as smartwatches, wristbands, or key fobs embedded with payment chips, allow you to make payments with a simple tap. F&B establishments are partnering with wearable technology providers to offer contactless payment options. These options enhance convenience and mobility for customers.

Image by Cova Software on Unsplash

Stay Ahead Through Streamlined Payment Processing

Streamlining payment processing in the F&B industry is essential for delivering seamless, secure, and convenient transaction experiences that meet your customers’ evolving needs and preferences.

By embracing digital payment solutions, integrating POS systems, and leveraging innovative technologies, your food and beverage business can enhance operational efficiency, improve customer satisfaction, and drive sustainable growth in an increasingly digitized industry.

RELATED ARTICLE: OPENING YOUR OWN RESTAURANT? 5 THINGS TO KNOW FIRST

However, your business must prioritize security, compliance, and data privacy while adopting and implementing payment processing solutions to safeguard customer trust and reputation.

With the right strategies and investments, your F&B establishment can unlock new opportunities for success and differentiation in the competitive restaurant landscape.

RELATED ARTICLE: 4 WAYS TO REDUCE LABOR COSTS IN YOUR RESTAURANT